Анатолий Шарий

Реальний Київ | Украина

Україна Сейчас | УС: новини, політика

Труха⚡️Україна

Николаевский Ванёк

Инсайдер UA

Реальна Війна | Україна | Новини

Лачен пише

Nairaland Pulse | News

Анатолий Шарий

Реальний Київ | Украина

Україна Сейчас | УС: новини, політика

Труха⚡️Україна

Николаевский Ванёк

Инсайдер UA

Реальна Війна | Україна | Новини

Лачен пише

Nairaland Pulse | News

Анатолий Шарий

Реальний Київ | Украина

Україна Сейчас | УС: новини, політика

English | Crypto Learn

Home of Learners and Earners!

Buy ads: https://telega.io/c/CryptoLearnEn

Ads: @Damien_S0 / @wiktorkrum

Buy ads: https://telega.io/c/CryptoLearnEn

Ads: @Damien_S0 / @wiktorkrum

记录

17.08.202423:59

27.1K订阅者30.11.202423:59

800引用指数09.11.202423:59

5.8K每帖平均覆盖率11.10.202423:59

1.6K广告帖子的平均覆盖率06.12.202423:59

22.22%ER18.03.202512:03

14.24%ERR

12.05.202510:40

3 DAYS TO GO. DO NOT MISS THIS OPPORTUNITY.

The biggest insider launch we’ve ever seen will happen on Crypto Pump Club’s channel in exactly 3 days.

Previous insider launches from CPC have yielded 2000% on average for their members. This is your chance.

Be the first to know: Join CPC

Link: https://t.me/+OFbN76W7hxoxYzI0

The biggest insider launch we’ve ever seen will happen on Crypto Pump Club’s channel in exactly 3 days.

Previous insider launches from CPC have yielded 2000% on average for their members. This is your chance.

Be the first to know: Join CPC

Link: https://t.me/+OFbN76W7hxoxYzI0

10.05.202503:58

⚙️ Trading Concept Explained 📚

Concept: Fibonacci Retracement

Fibonacci Retracement is a tool used by crypto traders to identify potential levels of support and resistance in a price trend. It's based on the Fibonacci sequence, where key percentages (23.6%, 38.2%, 50%, 61.8%, and 78.6%) are used to predict how much of a previous move in price might be retraced before continuing in the original direction. Understanding these levels can give traders an edge by helping them make more informed decisions about when to enter or exit trades. By recognizing these retracement levels, traders can better anticipate where the price might pause or reverse, thus optimizing their trading strategies.

For example, if Bitcoin's price surges from $30,000 to $40,000, a trader using Fibonacci Retracement might predict potential pullback levels. If the price retraces to the 61.8% level, which would be around $33,840, the trader might see this as a buying opportunity, expecting the price to resume its upward trend. By entering the trade at this retracement level, the trader could potentially buy low and benefit from the subsequent rise in price, illustrating the practical usefulness of this tool.

English | Crypto Academy ✅️

Concept: Fibonacci Retracement

Fibonacci Retracement is a tool used by crypto traders to identify potential levels of support and resistance in a price trend. It's based on the Fibonacci sequence, where key percentages (23.6%, 38.2%, 50%, 61.8%, and 78.6%) are used to predict how much of a previous move in price might be retraced before continuing in the original direction. Understanding these levels can give traders an edge by helping them make more informed decisions about when to enter or exit trades. By recognizing these retracement levels, traders can better anticipate where the price might pause or reverse, thus optimizing their trading strategies.

For example, if Bitcoin's price surges from $30,000 to $40,000, a trader using Fibonacci Retracement might predict potential pullback levels. If the price retraces to the 61.8% level, which would be around $33,840, the trader might see this as a buying opportunity, expecting the price to resume its upward trend. By entering the trade at this retracement level, the trader could potentially buy low and benefit from the subsequent rise in price, illustrating the practical usefulness of this tool.

English | Crypto Academy ✅️

11.05.202519:45

🚀 $MBG Token – 27 000 $MBG airdrop is live!

Powered by MultiBank Group

• 17 regulatory licences

• $29 B in real-world assets

• $35 B+ daily trading volume

Why $MBG

• Real utility: trading, staking, RWA tokenisation

• $440 M buy-back & burn securing long-term value

• Exclusive market briefings and early-listing access

🎁 Enter the 27 000 $MBG draw: join the channel, follow the updates, and watch for the winners.

👉 Join now → https://tglink.io/d31cc46dc114

Powered by MultiBank Group

• 17 regulatory licences

• $29 B in real-world assets

• $35 B+ daily trading volume

Why $MBG

• Real utility: trading, staking, RWA tokenisation

• $440 M buy-back & burn securing long-term value

• Exclusive market briefings and early-listing access

🎁 Enter the 27 000 $MBG draw: join the channel, follow the updates, and watch for the winners.

👉 Join now → https://tglink.io/d31cc46dc114

23.04.202511:12

Are you enjoying our content? Advertise on this channel and reach a highly engaged audience and subscribers! 👉🏻

Adsince.io is a fast, easy, and 100% trustworthy website for promoting your products and services on Telegram channels. There are many Telegram channels on Adsince that are suitable for advertising, so come and visit us.

⚡️ Place your ad here in three simple steps:

Sign up

Top up the balance in a convenient way

Create your advertising post

✨ Start your promotion journey now!

Adsince.io is a fast, easy, and 100% trustworthy website for promoting your products and services on Telegram channels. There are many Telegram channels on Adsince that are suitable for advertising, so come and visit us.

⚡️ Place your ad here in three simple steps:

Sign up

Top up the balance in a convenient way

Create your advertising post

✨ Start your promotion journey now!

07.05.202510:41

📈 141 Days Since Bitcoin's ATH – What’s Next?

It’s been 141 days since Bitcoin hit its last all-time high. Historically, it takes around 211 days on average to reach a new ATH — meaning we could be just 70 days away from the next one if the pattern holds. ⏳

But some are more optimistic: CryptoQuant analyst Alex Adler believes Bitcoin might break its record even sooner. Stay sharp — the next leg up could be closer than expected! 🚀

English | Crypto Academy ✅️

It’s been 141 days since Bitcoin hit its last all-time high. Historically, it takes around 211 days on average to reach a new ATH — meaning we could be just 70 days away from the next one if the pattern holds. ⏳

But some are more optimistic: CryptoQuant analyst Alex Adler believes Bitcoin might break its record even sooner. Stay sharp — the next leg up could be closer than expected! 🚀

English | Crypto Academy ✅️

15.05.202504:49

🔗 Concept: Day Trading

Day Trading involves buying and selling cryptocurrencies within the same trading day to capitalize on short-term price movements. For crypto traders, mastering day trading can significantly enhance their ability to profit from the volatile nature of the crypto market. By focusing on intraday trends, traders can potentially increase their returns while minimizing overnight risk exposure. Understanding day trading gives you a tactical edge, allowing you to make quick, informed decisions based on real-time market data.

Example: Imagine you notice that Bitcoin typically experiences a price surge around 10 AM due to increased trading volume from a specific region. As a day trader, you could buy Bitcoin at 9:50 AM and sell it at 10:10 AM, capitalizing on this predictable pattern. This strategy could net you a small but consistent profit each day, which, when compounded over time, could lead to significant gains. By applying day trading techniques, you're leveraging short-term market inefficiencies to your advantage.

English | Crypto Academy ✅️

Day Trading involves buying and selling cryptocurrencies within the same trading day to capitalize on short-term price movements. For crypto traders, mastering day trading can significantly enhance their ability to profit from the volatile nature of the crypto market. By focusing on intraday trends, traders can potentially increase their returns while minimizing overnight risk exposure. Understanding day trading gives you a tactical edge, allowing you to make quick, informed decisions based on real-time market data.

Example: Imagine you notice that Bitcoin typically experiences a price surge around 10 AM due to increased trading volume from a specific region. As a day trader, you could buy Bitcoin at 9:50 AM and sell it at 10:10 AM, capitalizing on this predictable pattern. This strategy could net you a small but consistent profit each day, which, when compounded over time, could lead to significant gains. By applying day trading techniques, you're leveraging short-term market inefficiencies to your advantage.

English | Crypto Academy ✅️

14.05.202513:44

✅ Join the Goldtradermo Channel for FREE

📈💥 High-Win-Rate Forex Signals!

💰 Don’t miss out on GMTO’s 💎 Profit Signals!

-> CLICK HERE TO JOIN

📈💥 High-Win-Rate Forex Signals!

💰 Don’t miss out on GMTO’s 💎 Profit Signals!

-> CLICK HERE TO JOIN

05.05.202508:49

President Trump said the crypto market was “much stronger” than the stock market during the recent crash, calling it “very popular” and “very hot.”

English | Crypto Academy ✅️

English | Crypto Academy ✅️

16.05.202504:11

🔗Concept: Bear Flag

A 'Bear Flag' is a bearish chart pattern that signals a potential continuation of a downtrend in cryptocurrency prices. It appears as a small upward trend (the flag) within a larger downward trend (the pole), indicating that the bears are taking a brief pause before pushing prices lower again. Recognizing this pattern can give crypto traders an edge by allowing them to anticipate and potentially profit from further price declines. By selling or shorting the cryptocurrency when the price breaks down from the flag, traders can capitalize on the expected continuation of the bearish move.

Example: Suppose a trader spots a Bear Flag pattern on the Bitcoin chart after a sharp decline from $50,000 to $45,000. The price then briefly rises to $46,000, forming the flag. The trader, recognizing the Bear Flag, decides to short Bitcoin at $46,000. When the price breaks down from the flag and continues the downtrend to $43,000, the trader closes the short position, securing a profit from the anticipated bearish move.

English | Crypto Academy ✅️

A 'Bear Flag' is a bearish chart pattern that signals a potential continuation of a downtrend in cryptocurrency prices. It appears as a small upward trend (the flag) within a larger downward trend (the pole), indicating that the bears are taking a brief pause before pushing prices lower again. Recognizing this pattern can give crypto traders an edge by allowing them to anticipate and potentially profit from further price declines. By selling or shorting the cryptocurrency when the price breaks down from the flag, traders can capitalize on the expected continuation of the bearish move.

Example: Suppose a trader spots a Bear Flag pattern on the Bitcoin chart after a sharp decline from $50,000 to $45,000. The price then briefly rises to $46,000, forming the flag. The trader, recognizing the Bear Flag, decides to short Bitcoin at $46,000. When the price breaks down from the flag and continues the downtrend to $43,000, the trader closes the short position, securing a profit from the anticipated bearish move.

English | Crypto Academy ✅️

08.05.202517:04

🇺🇸 Eric Trump: “Trump Owns a Lot of Bitcoin”

Eric Trump revealed that both he and Donald Trump hold significant amounts of Bitcoin, calling it “digital gold” with massive future potential. 🚀

- Eric said, predicting exponential growth for BTC in the coming years.

Looks like Bitcoin just got another campaign donor. 🧢📈

English | Crypto Academy ✅️

Eric Trump revealed that both he and Donald Trump hold significant amounts of Bitcoin, calling it “digital gold” with massive future potential. 🚀

“I love Bitcoin… I own a lot of it, and Trump owns a lot of it”

- Eric said, predicting exponential growth for BTC in the coming years.

Looks like Bitcoin just got another campaign donor. 🧢📈

English | Crypto Academy ✅️

12.05.202508:23

Tariff Truce Boosts Market Confidence 🤝

The U.S. and China have agreed to a 90-day mutual tariff reduction: China drops duties on U.S. goods from 125% to 10%, while the U.S. cuts Chinese tariffs from 145% to 30%. Additional U.S. tariffs imposed in April have been revoked. 🔥

The two nations will establish a permanent dialogue mechanism to address trade and economic issues, aiming to reduce the trade imbalance. However, currency matters and fentanyl remain unresolved. 👀

Officials say the breakthrough restores key communication channels and sets the stage for improved global trade relations — markets are already reacting. 🚀

English | Crypto Academy ✅️

The U.S. and China have agreed to a 90-day mutual tariff reduction: China drops duties on U.S. goods from 125% to 10%, while the U.S. cuts Chinese tariffs from 145% to 30%. Additional U.S. tariffs imposed in April have been revoked. 🔥

The two nations will establish a permanent dialogue mechanism to address trade and economic issues, aiming to reduce the trade imbalance. However, currency matters and fentanyl remain unresolved. 👀

Officials say the breakthrough restores key communication channels and sets the stage for improved global trade relations — markets are already reacting. 🚀

English | Crypto Academy ✅️

02.05.202504:29

Bitcoin surges, Ethereum struggles: April in crypto

BTC surged by 14.2% in April, marking its strongest month since March 2024.

ETH didn’t share the momentum, falling by 1.58% — its fifth monthly decline in a row. That’s its worst streak since 2018.

ETH bulls might want to sit down for this one.

English | Crypto Academy ✅️

BTC surged by 14.2% in April, marking its strongest month since March 2024.

ETH didn’t share the momentum, falling by 1.58% — its fifth monthly decline in a row. That’s its worst streak since 2018.

ETH bulls might want to sit down for this one.

English | Crypto Academy ✅️

19.05.202518:17

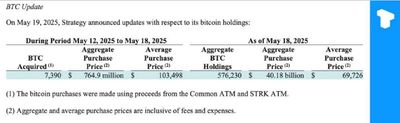

Strategy (former MicroStrategy) has acquired 7,390 BTC for ~$764.9m at an average price of ~$103,498 per BTC, reaching a 16.3% BTC yield year-to-date in 2025.

As of May 19, the company holds 576,230 BTC, bought for a total of ~$40.18bn at an average cost of ~$69,726 per coin.

English | Crypto Academy ✅️

As of May 19, the company holds 576,230 BTC, bought for a total of ~$40.18bn at an average cost of ~$69,726 per coin.

English | Crypto Academy ✅️

26.04.202504:55

Ethereum's market dominance has dropped to just 7.4%, approaching levels seen in 2020.

In 2021, 1 ETH was equivalent to 0.08 BTC, but today it is worth just 0.018 BTC, representing a 4-fold decrease.

English | Crypto Academy ✅️

In 2021, 1 ETH was equivalent to 0.08 BTC, but today it is worth just 0.018 BTC, representing a 4-fold decrease.

English | Crypto Academy ✅️

12.05.202512:23

📈 Strategy Adds 13,390 BTC to Holdings

Strategy has acquired 13,390 BTC for $1.34B at an average price of $99,856 per Bitcoin, bringing its total holdings to 568,840 BTC — worth ~$39.41B. 💰

The firm now holds Bitcoin at an average entry of $69,287 and reports a 15.5% BTC yield YTD (2025). 🚀

Another massive buy confirming Strategy’s long-term conviction in Bitcoin.

English | Crypto Academy ✅️

Strategy has acquired 13,390 BTC for $1.34B at an average price of $99,856 per Bitcoin, bringing its total holdings to 568,840 BTC — worth ~$39.41B. 💰

The firm now holds Bitcoin at an average entry of $69,287 and reports a 15.5% BTC yield YTD (2025). 🚀

Another massive buy confirming Strategy’s long-term conviction in Bitcoin.

English | Crypto Academy ✅️

登录以解锁更多功能。