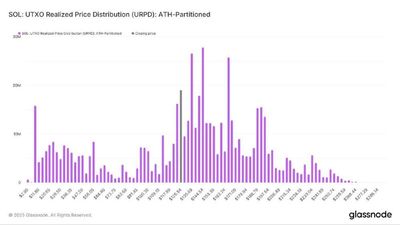

Glassnode

Pioneering on-chain market analysis.

Advanced charts/data/insights for investors in Bitcoin and digital assets.

https://studio.glassnode.com/

Advanced charts/data/insights for investors in Bitcoin and digital assets.

https://studio.glassnode.com/

TGlist рейтинг

0

0

ТипАчык

Текшерүү

ТекшерилбегенИшенимдүүлүк

ИшенимсизОрду

ТилиБашка

Канал түзүлгөн датаMay 07, 2025

TGlistке кошулган дата

Oct 01, 2023Рекорддор

21.02.202520:05

47.3KКатталгандар17.04.202523:59

300Цитация индекси23.01.202512:39

4.6K1 посттун көрүүлөрү28.02.202523:59

4.6K1 жарнама посттун көрүүлөрү19.09.202423:59

1.13%ER14.02.202502:34

9.74%ERRӨнүгүү

Катталуучулар

Citation индекси

Бир посттун көрүүсү

Жарнамалык посттун көрүүсү

ER

ERR

Көбүрөөк функцияларды ачуу үчүн кириңиз.